WOODEN MARKET FORECAST Q3/2024

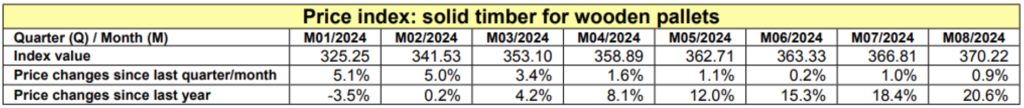

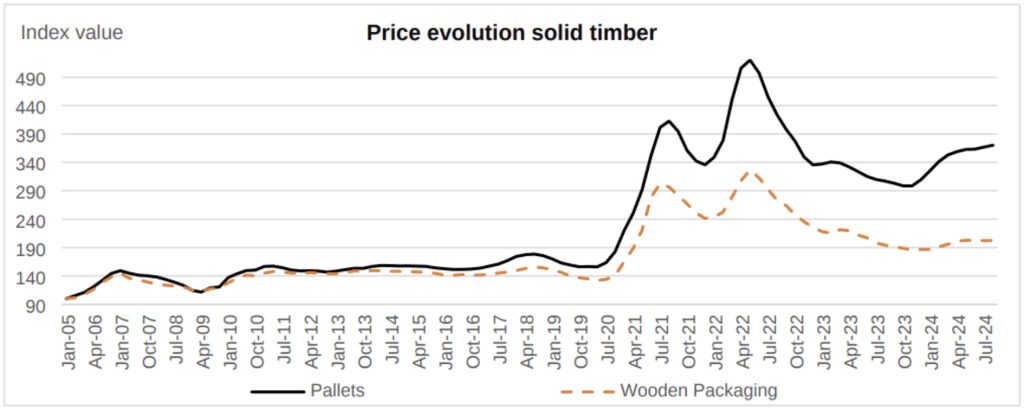

16.07.2024As usual, we are pleased to present the latest developments in the wood market. In our last communication from March of this year, we anticipated further increases in lumber prices during the second quarter of 2024. Once again, our experts have proven to be accurate in their forecasts.

Read More