General market situation

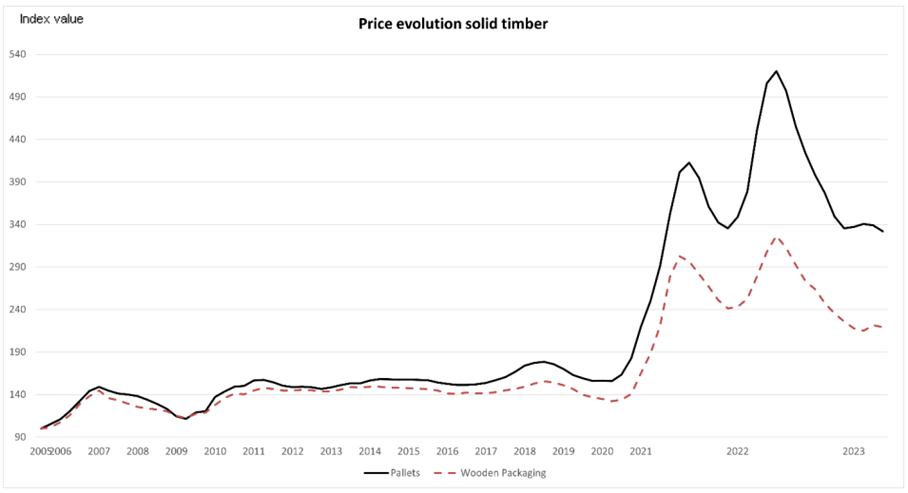

In our latest market overview letter, we’ve shared with you all major market trends and indicators. One of the main insights was the fact that due to the warm weather in winter energy wood (pellets, briquettes and fire wood) prices declined sharper than expected. Meaning that unlikely in the past, sawmills couldn’t balance lower prices for sawn timber with higher prices for energy wood.

Due to that basically all sawmills started to push for higher prices for sawn timber. We must admit, sawmills had their arguments such as increased production costs due to higher energy prices and overall inflation. But the golden market rule about supply and demands balanced the situation at the end. So, even some indexes like HPE showed slight increase in January and February and raw material prices increased, for ready products prices stayed more or less flat in Q1/2023.

But what are the main reasons prices for finished goods didn’t increase as expected during Q1 / 2023? Main reason is the relatively low demands from the market for sawn timber due to:

- Low demands from construction industry because of the high interest rate

- Cold weather in March and April put the brakes on demands from DIY and Gardening industry

- Economy driving with half speed results in low demand for industrial packaging.

Looking now on some market indicators such as increasing orders on hands at sawmills, increasing consumer confidence and purchase manager indexes, as well as better weather conditions, we can infer that the prices are not going to go much lower as they are now. Our market analysts do not expect sharp price changes in May. Moreover, for May we expect price level like April.

Starting from June, due to the increasing indicators mentioned above, we foresee possible price adjustment in June. Although, due to the unclear prospects of construction industry and overall economic turmoil the seasonal price increase is not expected to be as high as usual.

Due to the current turbulences on the market other scenarios like sidewards moving prices or even slight decreases are possible as well.