Conclusions

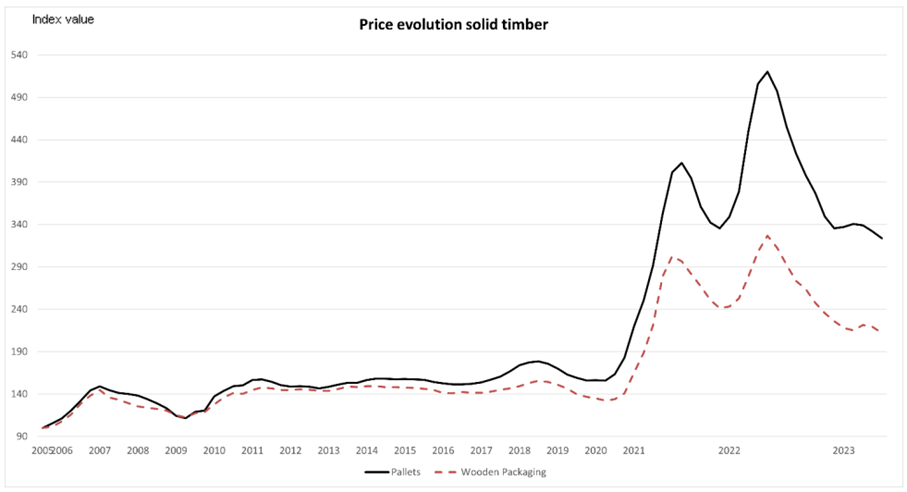

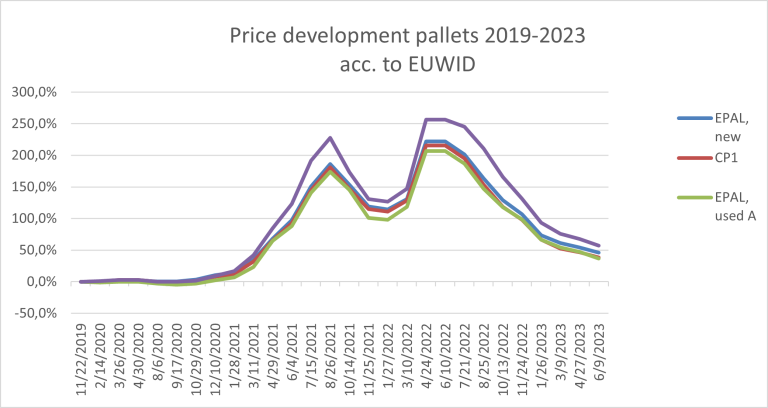

As usual, it is extremely difficult to predict the further development of wooden prices. Currently, we are seeing different trends in the European and US markets. Forecasts in some industries, such as DIY and Gardening, are cautiously optimistic, while others, like construction, are struggling with high-interest rates. However, positive market data can quickly trigger a price rally, as recently observed in the US market.

Based on historical data, the current average price level is nearly at a 24-month low. Therefore, it is highly unlikely that we will see a significant further decrease in raw material prices. Most probably, prices will stabilize at the current level for Q3, with slight fluctuations within a small range.

Hence, our recommendation for short or midterm purchases is to maintain your regular purchasing activities based on your actual needs. For customers planning deliveries for the 2024 season, our strong recommendation would be to close the contract during July/August.

However, the market is currently very volatile, and any changes in demand, customer behavior, interest rates, or other market data can potentially alter the price trend in one direction or another. Therefore, we must closely monitor market indicators and remain flexible and ready to adjust our approach to possible market changes.

At Kronus, we are well-prepared for the forthcoming challenges and closely monitoring the market. We will keep you informed about further market developments.